NEWS

View AllLeaders, candidates concludes hectic canvassing; Poll campaign ends in TN, booths ready for voting on Apr 19

April 17, 2024DMK-Cong, AIADMK-DMDK, BJP-PMK in tri-corner fight BJP front: The BJP is contesting in 19 seats, PMK in 10, TMC in...

MarketCentral App for MSMEs

April 17, 2024NATO dilemma

April 17, 2024Delimitation of LS constituencies threat to TN : Stalin

April 17, 2024E-Book

2023 ஆம் ஆண்டின் சாதனை பெண்கள்

MarketCentral App for MSMEs

April 17, 2024

NATO dilemma

April 17, 2024

Delimitation of LS constituencies threat to TN : Stalin

April 17, 2024

TASMAC closed for 3 days in TN

April 17, 2024

Beware, MacOS Ventura update is full of bugs

April 17, 2024

Seoul plans AI safety summit in May

April 17, 2024

World IT Show 2024 begins in Seoul

April 17, 2024

Revolutionizing democratic processes, AI way

April 17, 2024

Best 14-inch laptops

April 17, 2024

ISRO develops light weight rocket engines

April 17, 2024

5 IS militants in Iraq killed in air strikes

April 17, 2024

Buttler aces Narine’s ton, helps RR beat KKR

April 17, 2024

Spinner Derek Underwood passes away

April 17, 2024

Sunrisers six flurry sinks RCB in their courtyard

April 16, 2024

MarketCentral App for MSMEs

April 17, 2024

NATO dilemma

April 17, 2024

Delimitation of LS constituencies threat to TN : Stalin

April 17, 2024

TASMAC closed for 3 days in TN

April 17, 2024

Beware, MacOS Ventura update is full of bugs

April 17, 2024

Seoul plans AI safety summit in May

April 17, 2024

World IT Show 2024 begins in Seoul

April 17, 2024

Revolutionizing democratic processes, AI way

April 17, 2024

Best 14-inch laptops

April 17, 2024

ISRO develops light weight rocket engines

April 17, 2024

5 IS militants in Iraq killed in air strikes

April 17, 2024

Buttler aces Narine’s ton, helps RR beat KKR

April 17, 2024

Spinner Derek Underwood passes away

April 17, 2024

Sunrisers six flurry sinks RCB in their courtyard

April 16, 2024

Cinema

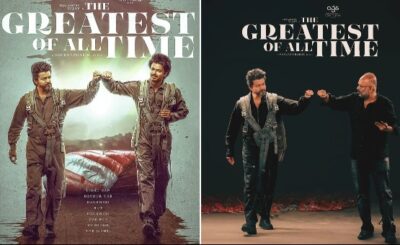

View AllVijay lends voice for ‘The G.O.A.T’ first single

April 14, 2024Chennai, Apr 14:The makers of Vijay's 'The Greatest Of All Time' announced...

STR goes for look change in ‘Thug Life’

April 14, 2024Spine-chilling teaser of ‘Sabdham’

April 14, 2024Sports

View AllButtler aces Narine’s ton, helps RR beat KKR

April 17, 2024Kolkata, Apr 17: Jos Buttler swung his bat merrily on way to...

Spinner Derek Underwood passes away

April 17, 2024

#slider > figure >a > img:hover {

-ms-transform: scale(1.5); /* IE 9 */

-webkit-transform: scale(1.5); /* Safari 3-8 */

transform: scale(1.1);

}

@keyframes slidy {

0% { left: 0%; }

20% { left: 0%; }

35% { left: -100%; }

45% { left: -100%; }

75% { left: -200%; }

85% { left: -200%; }

100% { left: -200%; }

}

body { margin: 0; }

div#slider { overflow: hidden; }

div#slider figure img { width: 20%; float: left; }

div#slider figure {

position: relative;

width: 500%;

margin: 0;

left: 0;

text-align: left;

font-size: 0;

animation: 10s slidy infinite;

}

Articles

View AllGathering storm before the ballot battle

April 14, 2024Middle East turmoil escalates as Iran pounds Israel

April 14, 2024Unforgettable politics based Tamil movies

April 14, 2024Tourism

View AllVaranasi sees boom in spiritual tourism

April 14, 2024Varanasi, Apr 14:The city of Varanasi is renowned for its sacred Ganga river, majestic ghats,...

No more smelly trains!!

April 14, 2024Chennai, Apr 14:Indian Railways is exploring new technologies and solutions to tackle...

Fun Facts!! AI imagines summer in ‘Parallel Universe’

April 14, 2024The viral Artificial Intelligence trend has taken over social media, and artists...