NEWS

View AllPaid holiday for staff: EC diktat

April 25, 2024Hyderabad, Apr 25: The Election Commission of India (ECI) has issued a communication stipulating that every individual employed in any...

Campaigning ends for first phase of Karnataka polls

April 25, 2024Army Chief urges self-reliance in defense equipment

April 25, 2024US Senate votes to ban TikTok

April 25, 2024Egypt, Netherlands push for early Gaza ceasefire

April 25, 2024E-Book

2023 ஆம் ஆண்டின் சாதனை பெண்கள்

Paid holiday for staff: EC diktat

April 25, 2024

Campaigning ends for first phase of Karnataka polls

April 25, 2024

Army Chief urges self-reliance in defense equipment

April 25, 2024

US Senate votes to ban TikTok

April 25, 2024

Egypt, Netherlands push for early Gaza ceasefire

April 25, 2024

Army modernisation

April 24, 2024

DRDO develops lightest bullet-proof jacket

April 24, 2024

Hi-profile campaign makes Chikkaballapur cynosure

April 24, 2024

King Charles bestows honour on British-Indian doctor

April 24, 2024

France partners India in ambitious museum project

April 24, 2024

India most populous

April 23, 2024

Pak’s Nida gets 100 ODI wickets; Windies win

April 23, 2024

Outstanding show earns Mizo’s Marina India shortlist

April 23, 2024

Bagan meet Odisha in ISL first leg semifinal

April 23, 2024

Pak, Iran vow to root out terror from their soils

April 23, 2024

Cong wants EC to censure Modi for poll speech

April 23, 2024

Karnataka BJP expels Eshwarappa for indiscipline

April 23, 2024

2 Indian students killed in US car accident

April 23, 2024

Paid holiday for staff: EC diktat

April 25, 2024

Campaigning ends for first phase of Karnataka polls

April 25, 2024

Army Chief urges self-reliance in defense equipment

April 25, 2024

US Senate votes to ban TikTok

April 25, 2024

Egypt, Netherlands push for early Gaza ceasefire

April 25, 2024

Army modernisation

April 24, 2024

DRDO develops lightest bullet-proof jacket

April 24, 2024

Hi-profile campaign makes Chikkaballapur cynosure

April 24, 2024

King Charles bestows honour on British-Indian doctor

April 24, 2024

France partners India in ambitious museum project

April 24, 2024

India most populous

April 23, 2024

Pak’s Nida gets 100 ODI wickets; Windies win

April 23, 2024

Outstanding show earns Mizo’s Marina India shortlist

April 23, 2024

Bagan meet Odisha in ISL first leg semifinal

April 23, 2024

Pak, Iran vow to root out terror from their soils

April 23, 2024

Cong wants EC to censure Modi for poll speech

April 23, 2024

Karnataka BJP expels Eshwarappa for indiscipline

April 23, 2024

2 Indian students killed in US car accident

April 23, 2024

Cinema

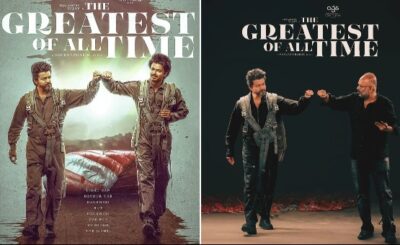

View AllVijay lends voice for ‘The G.O.A.T’ first single

April 14, 2024Chennai, Apr 14:The makers of Vijay's 'The Greatest Of All Time' announced...

STR goes for look change in ‘Thug Life’

April 14, 2024Spine-chilling teaser of ‘Sabdham’

April 14, 2024Sports

View AllChahal first bowler to reach 200 IPL wickets; RR’s ton-up Jaiswal stuns MI into submission

April 23, 2024Jaipur, Apr 23: Yuzvendra Chahal, the Rajasthan Royals leg-spinner, has etched his...

Pak’s Nida gets 100 ODI wickets; Windies win

April 23, 2024Outstanding show earns Mizo’s Marina India shortlist

April 23, 2024

#slider > figure >a > img:hover {

-ms-transform: scale(1.5); /* IE 9 */

-webkit-transform: scale(1.5); /* Safari 3-8 */

transform: scale(1.1);

}

@keyframes slidy {

0% { left: 0%; }

20% { left: 0%; }

35% { left: -100%; }

45% { left: -100%; }

75% { left: -200%; }

85% { left: -200%; }

100% { left: -200%; }

}

body { margin: 0; }

div#slider { overflow: hidden; }

div#slider figure img { width: 20%; float: left; }

div#slider figure {

position: relative;

width: 500%;

margin: 0;

left: 0;

text-align: left;

font-size: 0;

animation: 10s slidy infinite;

}

Articles

View AllGathering storm before the ballot battle

April 14, 2024Middle East turmoil escalates as Iran pounds Israel

April 14, 2024Unforgettable politics based Tamil movies

April 14, 2024Tourism

View AllVaranasi sees boom in spiritual tourism

April 14, 2024Varanasi, Apr 14:The city of Varanasi is renowned for its sacred Ganga river, majestic ghats,...

No more smelly trains!!

April 14, 2024Chennai, Apr 14:Indian Railways is exploring new technologies and solutions to tackle...

Fun Facts!! AI imagines summer in ‘Parallel Universe’

April 14, 2024The viral Artificial Intelligence trend has taken over social media, and artists...